31 Jan Rental Property Loss Ring Fencing

From 1 April 2019, one of the proposed changes to tax law will mean that losses on rental properties will not be able to be off set against income from other sources. We have had these kind of tax rules many years ago. They were scraped as being more costly to administer than the revenue gained from them.

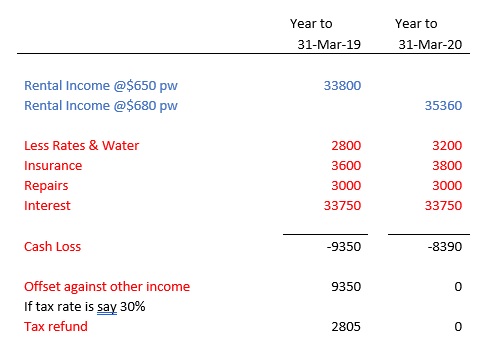

So how will this “work?” Here is a worked example:

An Auckland rental property purchased 1 April 2018 for $800,000, with a mortgage secured over that property and an existing home. Own funds in $50,000. Rental income is $650 per week, rising to $680 next year, no letting agent. Continuously tenanted. Some minor repairs.

In this example, a tax refund will be generated for the 2019 year of $2805. The proposed rules will stop this refund in 2020. The losses can be used against taxable income from the property in future years, or offset against income from other properties.

Planning implications

Cash flow for 2020 should exclude the tax refund – that cash will inevitably have to come from elsewhere, most probably from the owner’s back pocket.

Given other recent requirements that have come into effect for landlords, it looks like owning residential rental properties is less attractive than it was 24 months ago.

If this change will impact you and you want to understand the size of that impact, do get in touch.