Tax Compliance

Tax compliance is crucial to a business. Failure to comply can lead to substantial fines which can cripple your company.

Let us help you make tax compliance a breeze. Tax compliance is our core work. We have extensive experience in this area – from filing your annual accounts, through to assistance and support in complex court cases. Our clients are also advantaged by our great working relationship with the Inland Revenue Department, as well as our up-to-date knowledge of any legislation changes regarding tax.

We like to prevent any nasty surprises, so our goal is to get things done on time and send out timely reminders to you to avoid any late penalties or interest.

Whatever your business, we will make it our business, and together we can work together to keep the tax man happy.

You can help us by providing us with the correct information when we need it – find out what we need from you here.

Payroll

Getting the payroll right can be a complicated issue, especially when it comes to all the various leave entitlements and rules surrounding employment law.

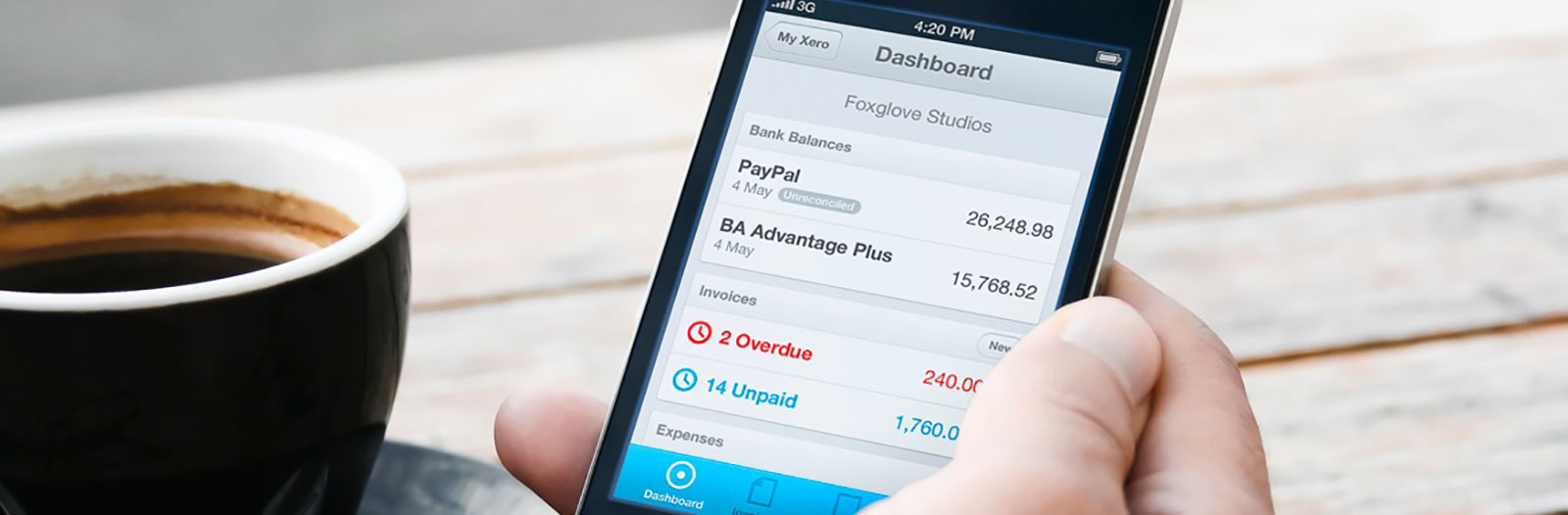

We use Xero Payroll and Crystal Payroll – both systems streamline the process and ensures the smooth running of payroll. Coupled with our knowledge and understanding of the Employment Relations Act and the Holidays Act, you can be rest assured that your staff will be paid correctly, on time, and that you are complying with the current legislation.

If you’re planning on taking on new staff, have a look through our Dealing with Employees or Contractors page to find out what information you’ll need.

Tax Planning

Where appropriate, tax planning can aid everyone. Tax planning requires a team approach with you, me and your lawyer (as there are usually legal considerations). We analyse your financial situation and identify the best ways to optimize your tax efficiency and minimize your tax liability.